All Categories

Featured

Table of Contents

Keep in mind, however, that this doesn't say anything regarding adjusting for inflation. On the plus side, also if you assume your choice would be to invest in the stock exchange for those 7 years, which you would certainly obtain a 10 percent annual return (which is much from certain, specifically in the coming years), this $8208 a year would be even more than 4 percent of the resulting nominal stock worth.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 settlement alternatives. Courtesy Charles Schwab. The regular monthly payout right here is highest for the "joint-life-only" choice, at $1258 (164 percent more than with the instant annuity). Nonetheless, the "joint-life-with-cash-refund" alternative pays only $7/month less, and warranties at the very least $100,000 will be paid out.

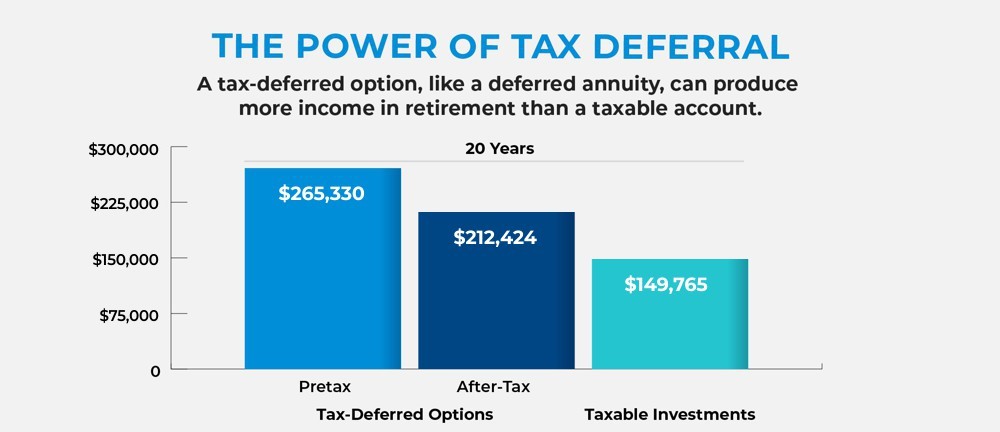

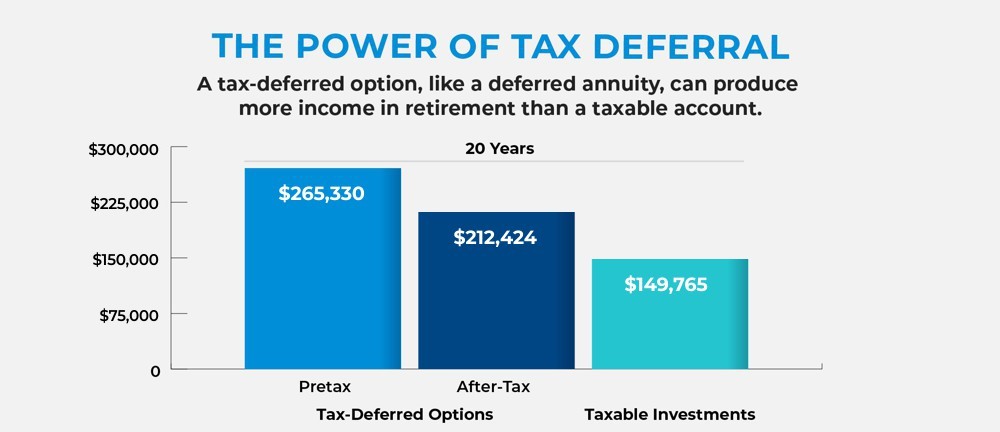

The means you get the annuity will determine the answer to that concern. If you get an annuity with pre-tax dollars, your costs decreases your taxable revenue for that year. According to , acquiring an annuity inside a Roth strategy results in tax-free repayments.

How does an Fixed Indexed Annuities help with retirement planning?

The consultant's primary step was to develop a comprehensive monetary prepare for you, and after that explain (a) exactly how the proposed annuity matches your total plan, (b) what options s/he thought about, and (c) how such options would certainly or would not have led to reduced or higher compensation for the consultant, and (d) why the annuity is the exceptional option for you. - Lifetime payout annuities

Naturally, a consultant may try pressing annuities also if they're not the most effective suitable for your situation and goals. The factor could be as benign as it is the only item they sell, so they drop prey to the typical, "If all you have in your tool kit is a hammer, pretty quickly everything starts resembling a nail." While the advisor in this circumstance might not be dishonest, it boosts the danger that an annuity is a poor choice for you.

What should I know before buying an Annuities?

Considering that annuities typically pay the agent selling them much higher payments than what s/he would certainly obtain for spending your cash in mutual funds - Annuity accumulation phase, allow alone the zero compensations s/he would certainly get if you purchase no-load mutual funds, there is a large reward for representatives to push annuities, and the more challenging the far better ()

An unscrupulous consultant suggests rolling that quantity into new "much better" funds that just happen to lug a 4 percent sales load. Agree to this, and the advisor pockets $20,000 of your $500,000, and the funds aren't likely to carry out better (unless you picked much more improperly to start with). In the same instance, the advisor might guide you to purchase a complicated annuity with that said $500,000, one that pays him or her an 8 percent compensation.

The advisor hasn't figured out just how annuity repayments will be strained. The expert hasn't divulged his/her compensation and/or the fees you'll be charged and/or hasn't shown you the influence of those on your ultimate settlements, and/or the compensation and/or fees are unacceptably high.

Present passion prices, and hence predicted settlements, are traditionally reduced. Even if an annuity is best for you, do your due persistance in comparing annuities offered by brokers vs. no-load ones sold by the issuing firm.

Who has the best customer service for Annuity Riders?

The stream of regular monthly payments from Social Security is similar to those of a deferred annuity. Given that annuities are volunteer, the people purchasing them usually self-select as having a longer-than-average life expectancy.

Social Security benefits are fully indexed to the CPI, while annuities either have no rising cost of living protection or at many offer a set percent yearly increase that might or may not compensate for inflation in full. This type of rider, similar to anything else that boosts the insurer's danger, requires you to pay more for the annuity, or accept lower settlements.

Annuity Accumulation Phase

Disclaimer: This write-up is planned for educational functions only, and should not be thought about financial suggestions. You must get in touch with a financial expert before making any major financial choices.

Since annuities are meant for retired life, taxes and fines may use. Principal Defense of Fixed Annuities.

Immediate annuities. Utilized by those who want dependable income quickly (or within one year of purchase). With it, you can tailor income to fit your demands and produce income that lasts permanently. Deferred annuities: For those who wish to expand their cash in time, yet are prepared to delay access to the cash till retirement years.

How do I choose the right Tax-deferred Annuities for my needs?

Variable annuities: Provides higher possibility for development by spending your money in investment alternatives you select and the capability to rebalance your portfolio based upon your choices and in a manner that lines up with changing economic objectives. With fixed annuities, the firm invests the funds and gives a rate of interest to the client.

:max_bytes(150000):strip_icc()/Cds-vs-annuities-5235446_final-22b750a10bc94d4a9fd265b91553ef4c.png)

When a fatality claim accompanies an annuity, it is necessary to have actually a called recipient in the agreement. Different options exist for annuity survivor benefit, depending upon the contract and insurer. Choosing a reimbursement or "duration specific" alternative in your annuity supplies a survivor benefit if you die early.

What does an Annuity Accumulation Phase include?

Naming a recipient various other than the estate can aid this process go a lot more smoothly, and can aid make sure that the earnings go to whoever the individual desired the cash to go to rather than going through probate. When existing, a death benefit is instantly included with your contract.

Table of Contents

Latest Posts

Exploring Variable Vs Fixed Annuity Key Insights on Your Financial Future What Is the Best Retirement Option? Features of Smart Investment Choices Why Variable Annuities Vs Fixed Annuities Is Worth Co

Analyzing Strategic Retirement Planning Key Insights on Immediate Fixed Annuity Vs Variable Annuity What Is Annuities Variable Vs Fixed? Features of Fixed Index Annuity Vs Variable Annuities Why Choos

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works What Is Tax Benefits Of Fixed Vs Variable Annuities? Pros and Cons of Various Financial Options Why Choosing t

More

Latest Posts